<【股票配资网站】>股票MACD指标视频详解:从入门到实战的完整指南

一、MACD指标概述

MACD( ,指数平滑异同移动平均线)是由 Appel于1970年代提出的经典技术分析指标。它通过计算不同周期的指数移动平均线(EMA)之间的差异,来判断市场趋势的强度和方向,是股票、期货、外汇等金融市场中最受欢迎的技术分析工具之一。

1.1 MACD的核心组成

MACD指标由三部分组成:

1.2 MACD的计算原理

MACD的计算基于指数移动平均线(EMA),主要步骤如下:

计算12日EMA(快速EMA)计算26日EMA(慢速EMA)DIF = 12日EMA – 26日 = DIF的9日柱 = (DIF – DEA) × 2二、MACD指标的通达信实现2.1 通达信基础MACD公式

DIF:EMA(CLOSE,12)-EMA(CLOSE,26);

DEA:EMA(DIF,9);

MACD:(DIF-DEA)*2,COLORSTICK;2.2 通达信增强版MACD公式

SHORT:=12;

LONG:=26;

MID:=9;

DIF:EMA(CLOSE,SHORT)-EMA(CLOSE,LONG);

DEA:EMA(DIF,MID);

MACD:(DIF-DEA)*2,COLORSTICK;

// 添加零轴参考线

Zero:0,COLORGRAY;

// 金叉死叉标记

JC:=CROSS(DIF,DEA);

SC:=CROSS(DEA,DIF);

DRAWICON(JC,DEA,1);

DRAWICON(SC,DEA,2);

// 柱状图颜色设置

STICKLINE(MACD>0,0,MACD,0.8,0),COLORRED;

STICKLINE(MACD<0,0,MACD,0.8,0),COLORGREEN;

// 顶底背离判断

LL:=LLV(L,60);

HH:=HHV(H,60);

LD:=BARSLAST(LL);

HD:=BARSLAST(HH);

BD:=REF(CLOSE,LD)>CLOSE AND REF(DIF,LD)10;

TD:=REF(CLOSE,HD)DIF AND HD>10;

DRAWTEXT(BD,DEA,'底背离'),COLORRED;

DRAWTEXT(TD,DEA,'顶背离'),COLORGREEN; 三、实现MACD指标3.1 使用基础计算MACD

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

def calculate_ema(prices, period):

return prices.ewm(span=period, adjust=False).mean()

def calculate_macd(close_prices, short=12, long=26, signal=9):

ema_short = calculate_ema(close_prices, short)

ema_long = calculate_ema(close_prices, long)

dif = ema_short - ema_long

dea = calculate_ema(dif, signal)

macd = (dif - dea) * 2

return dif, dea, macd

# 示例使用

# 假设df是一个包含收盘价的DataFrame

# dif, dea, macd = calculate_macd(df['close'])3.2 使用TA-Lib库计算MACD

import talib

def talib_macd(close_prices, short=12, long=26, signal=9):

dif, dea, macd = talib.MACD(close_prices,

fastperiod=short,

slowperiod=long,

signalperiod=signal)

return dif, dea, macd3.3 完整的 MACD可视化实现

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import gridspec

def plot_macd(close_prices, short=12, long=26, signal=9):

# 计算MACD

ema_short = close_prices.ewm(span=short, adjust=False).mean()

ema_long = close_prices.ewm(span=long, adjust=False).mean()

dif = ema_short - ema_long

dea = dif.ewm(span=signal, adjust=False).mean()

macd = (dif - dea) * 2

# 创建图表

fig = plt.figure(figsize=(12, 8))

gs = gridspec.GridSpec(2, 1, height_ratios=[3, 1])

# 价格图表

ax1 = plt.subplot(gs[0])

ax1.plot(close_prices.index, close_prices, label='Close Price', color='black')

ax1.plot(ema_short.index, ema_short, label=f'EMA {short}', color='blue', alpha=0.5)

ax1.plot(ema_long.index, ema_long, label=f'EMA {long}', color='red', alpha=0.5)

ax1.set_title('Price with EMA Lines')

ax1.legend()

# MACD图表

ax2 = plt.subplot(gs[1])

ax2.plot(dif.index, dif, label='DIF', color='blue')

ax2.plot(dea.index, dea, label='DEA', color='orange')

ax2.bar(macd.index, macd, label='MACD', color=np.where(macd > 0, 'red', 'green'))

ax2.axhline(0, color='gray', linestyle='--')

ax2.set_title('MACD Indicator')

ax2.legend()

plt.tight_layout()

plt.show()

# 示例使用

# 假设有一个包含收盘价的Series

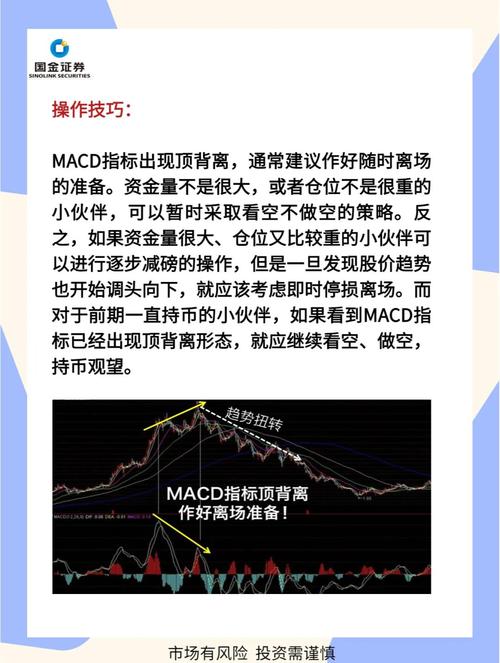

# plot_macd(df['close'])四、MACD指标的深度解析4.1 MACD的买卖信号金叉与死叉:柱状图变化:零轴位置:4.2 MACD背离分析顶背离:底背离:背离的确认:4.3 MACD参数优化标准参数(12,26,9):短线交易参数(6,13,5):长线投资参数(19,39,9):五、MACD实战策略5.1 基础交易策略

def macd_trading_strategy(close_prices):

dif, dea, macd = calculate_macd(close_prices)

signals = pd.DataFrame(index=close_prices.index)

signals['price'] = close_prices

signals['dif'] = dif

signals['dea'] = dea

signals['macd'] = macd

# 生成交易信号

signals['signal'] = 0

signals['signal'][dif > dea] = 1 # 买入信号

signals['signal'][dif < dea] = -1 # 卖出信号

# 计算持仓变化

signals['positions'] = signals['signal'].diff()

return signals5.2 增强版MACD策略(含过滤条件)

def enhanced_macd_strategy(close_prices, ma_period=50):

dif, dea, macd = calculate_macd(close_prices)

ma = close_prices.rolling(ma_period).mean()

signals = pd.DataFrame(index=close_prices.index)

signals['price'] = close_prices

signals['dif'] = dif

signals['dea'] = dea

signals['ma'] = ma

# 生成交易信号(增加过滤条件)

signals['signal'] = 0

# 买入条件:DIF上穿DEA且价格在均线上方

signals.loc[(dif > dea) & (dif.shift(1) <= dea.shift(1)) & (close_prices > ma), 'signal'] = 1

# 卖出条件:DIF下穿DEA且价格在均线下方

signals.loc[(dif < dea) & (dif.shift(1) >= dea.shift(1)) & (close_prices < ma), 'signal'] = -1

# 计算持仓变化

signals['positions'] = signals['signal'].diff()

return signals5.3 MACD结合RSI的多因子策略

def macd_rsi_strategy(close_prices, rsi_period=14, rsi_upper=70, rsi_lower=30):

# 计算MACD

dif, dea, macd = calculate_macd(close_prices)

# 计算RSI

delta = close_prices.diff()

gain = delta.where(delta > 0, 0)

loss = -delta.where(delta < 0, 0)

avg_gain = gain.rolling(rsi_period).mean()

avg_loss = loss.rolling(rsi_period).mean()

rs = avg_gain / avg_loss

rsi = 100 - (100 / (1 + rs))

signals = pd.DataFrame(index=close_prices.index)

signals['price'] = close_prices

signals['dif'] = dif

signals['dea'] = dea

signals['rsi'] = rsi

# 生成交易信号

signals['signal'] = 0

# 买入条件:MACD金叉且RSI从超卖区回升

signals.loc[(dif > dea) & (dif.shift(1) <= dea.shift(1)) &

(rsi > rsi_lower) & (rsi.shift(1) <= rsi_lower), 'signal'] = 1

# 卖出条件:MACD死叉且RSI从超买区回落

signals.loc[(dif < dea) & (dif.shift(1) >= dea.shift(1)) &

(rsi < rsi_upper) & (rsi.shift(1) >= rsi_upper), 'signal'] = -1

# 计算持仓变化

signals['positions'] = signals['signal'].diff()

return signals六、MACD指标的局限性及改进6.1 MACD的局限性滞后性问题:作为趋势跟随指标,MACD对价格变化的反应存在滞后震荡市表现不佳:在横盘整理阶段容易产生虚假信号参数敏感性:不同市场、不同品种可能需要调整参数单一指标风险:单独使用MACD可能产生较多错误信号6.2 MACD的改进方法结合趋势过滤:多时间框架验证:结合成交量分析:与其他指标组合:七、MACD在不同市场的应用差异7.1 股票市场中的MACD应用适合趋势明显的个股:对大盘股、指数ETF效果较好结合基本面使用:MACD信号与财报发布时间、行业周期结合注意停牌影响:A股市场停牌会影响EMA计算连续性7.2 期货市场中的MACD应用注意合约换月:主力合约切换时需要重新计算MACD杠杆效应放大风险:MACD假信号在杠杆市场代价更高不同品种参数调整:波动率高的品种可能需要调整参数7.3 外汇市场中的MACD应用24小时市场特性:无需考虑隔夜跳空对EMA计算的影响主要货币对表现:流动性高的货币对MACD信号更可靠多时间框架分析:1小时、4小时、日线MACD结合使用八、MACD指标的高级应用8.1 MACD柱状图形态分析山峰与谷底形态:柱状图收敛:零轴附近的形态:8.2 多周期MACD分析

def multi_timeframe_macd(daily_close, weekly_close):

# 计算日线MACD

daily_dif, daily_dea, _ = calculate_macd(daily_close)

# 计算周线MACD

weekly_dif, weekly_dea, _ = calculate_macd(weekly_close)

# 对齐时间索引

weekly_dif = weekly_dif.reindex(daily_close.index, method='ffill')

weekly_dea = weekly_dea.reindex(daily_close.index, method='ffill')

signals = pd.DataFrame(index=daily_close.index)

signals['price'] = daily_close

signals['daily_dif'] = daily_dif

signals['daily_dea'] = daily_dea

signals['weekly_dif'] = weekly_dif

signals['weekly_dea'] = weekly_dea

# 生成交易信号(日线和周线同向时交易)

signals['signal'] = 0

# 买入条件:日线金叉且周线MACD在零轴上方

signals.loc[(daily_dif > daily_dea) & (daily_dif.shift(1) <= daily_dea.shift(1)) &

(weekly_dif > 0) & (weekly_dea > 0), 'signal'] = 1

# 卖出条件:日线死叉且周线MACD在零轴下方

signals.loc[(daily_dif < daily_dea) & (daily_dif.shift(1) >= daily_dea.shift(1)) &

(weekly_dif < 0) & (weekly_dea < 0), 'signal'] = -1

return signals8.3 MACD与价格形态结合突破形态确认:趋势线分析:支撑阻力应用:九、MACD指标的量化回测9.1 回测框架示例

import backtrader as bt

class MacdStrategy(bt.Strategy):

params = (

('short', 12),

('long', 26),

('signal', 9),

('printlog', False),

)

def __init__(self):

self.macd = bt.indicators.MACD(self.data.close,

period_me1=self.p.short,

period_me2=self.p.long,

period_signal=self.p.signal)

self.crossover = bt.indicators.CrossOver(self.macd.macd, self.macd.signal)

def next(self):

if not self.position:

if self.crossover > 0: # MACD线上穿信号线

self.buy()

elif self.crossover < 0: # MACD线下穿信号线

self.close()

def log(self, txt, dt=None, doprint=False):

if self.params.printlog or doprint:

dt = dt or self.datas[0].datetime.date(0)

print(f'{dt.isoformat()}, {txt}')

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

return

if order.status == order.Completed:

if order.isbuy():

self.log(f'BUY EXECUTED, Price: {order.executed.price:.2f}, Cost: {order.executed.value:.2f}, Comm: {order.executed.comm:.2f}')

else:

self.log(f'SELL EXECUTED, Price: {order.executed.price:.2f}, Cost: {order.executed.value:.2f}, Comm: {order.executed.comm:.2f}')

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

def notify_trade(self, trade):

if not trade.isclosed:

return

self.log(f'OPERATION PROFIT, GROSS {trade.pnl:.2f}, NET {trade.pnlcomm:.2f}')

# 使用示例

# cerebro = bt.Cerebro()

# data = bt.feeds.YahooFinanceData(dataname='AAPL', fromdate=datetime(2020,1,1), todate=datetime(2023,1,1))

# cerebro.adddata(data)

# cerebro.addstrategy(MacdStrategy)

# cerebro.run()

# cerebro.plot()9.2 回测结果分析要点胜率与盈亏比:MACD策略的胜率和平均盈利/亏损比最大回撤:策略运行期间的最大资金回撤夏普比率:衡量风险调整后的收益信号频率:交易信号产生的频率及可交易性参数敏感性:不同参数组合下的表现稳定性9.3 回测优化建议避免过度拟合:多品种测试:交易成本考量:十、MACD指标的创新与未来发展10.1 MACD的机器学习改进参数自适应MACD:MACD信号分类模型:深度学习MACD:10.2 高频交易中的MACD应用Tick级MACD计算:盘口数据结合:微观结构分析:10.3 跨市场MACD分析相关性市场MACD联动:宏观经济指标MACD:加密货币市场应用:结语

MACD作为经典技术分析工具,历经数十年市场检验依然被广泛使用,其核心价值在于简洁有效地捕捉趋势变化。然而,没有任何指标是完美的,MACD同样需要在正确的市场环境中配合其他分析工具使用。随着计算技术的发展,传统MACD正在与量化分析、机器学习等新方法结合,展现出新的生命力。

无论是通过通达信等传统交易软件股票MACD指标视频详解:从入门到实战的完整指南,还是使用等编程语言实现股票macd指标视频详解,理解MACD的核心原理和适用条件都是关键。投资者应当根据自身交易风格和市场特点,灵活调整MACD参数和使用方法,将其纳入完整的交易体系中,而非孤立依赖。

技术分析的本质是概率游戏,MACD提供的是一种提高胜率的工具,而非确定性预测。持续学习、实践验证、纪律执行,才是技术分析发挥效用的根本保证。